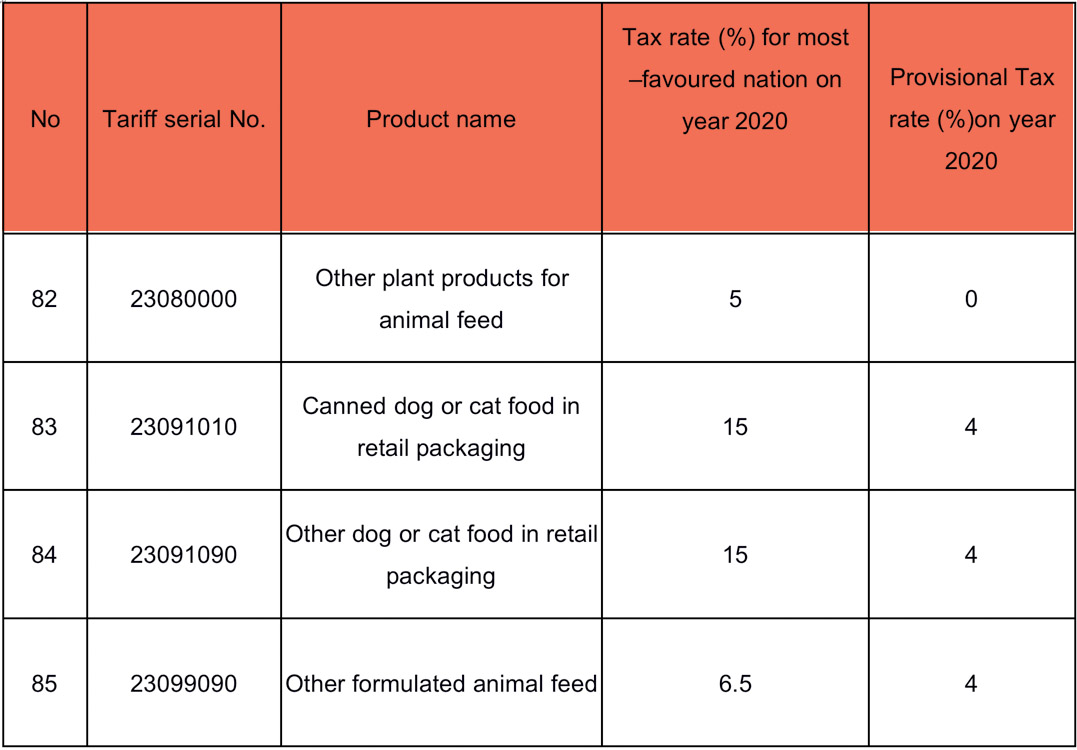

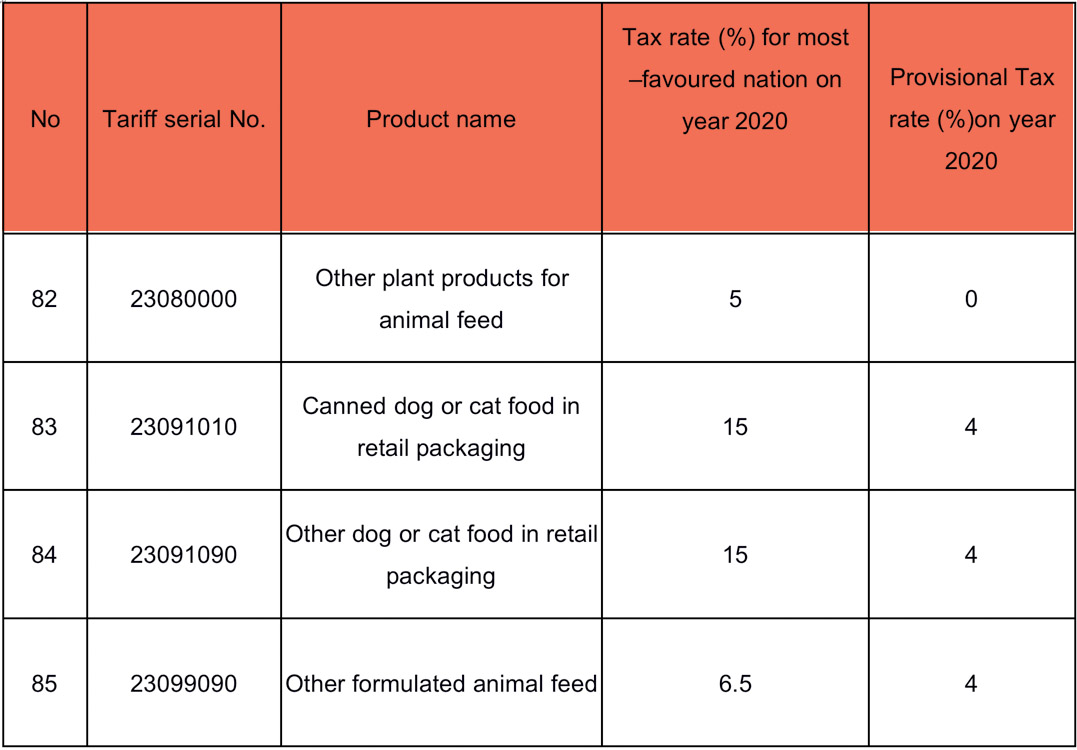

The tax rate of canned dog or cat food in retail packaging, and other dog or cat food in import retail packaging will be reduced from 15% to 4%, and the tax rate of other plant products for animal feed will be reduced to 0.

On December 23, China’s Customs Tariff Commission of the State Council announced it will temporarily adjust import tariffs on 859 commodities to come into effect January 1, 2020.

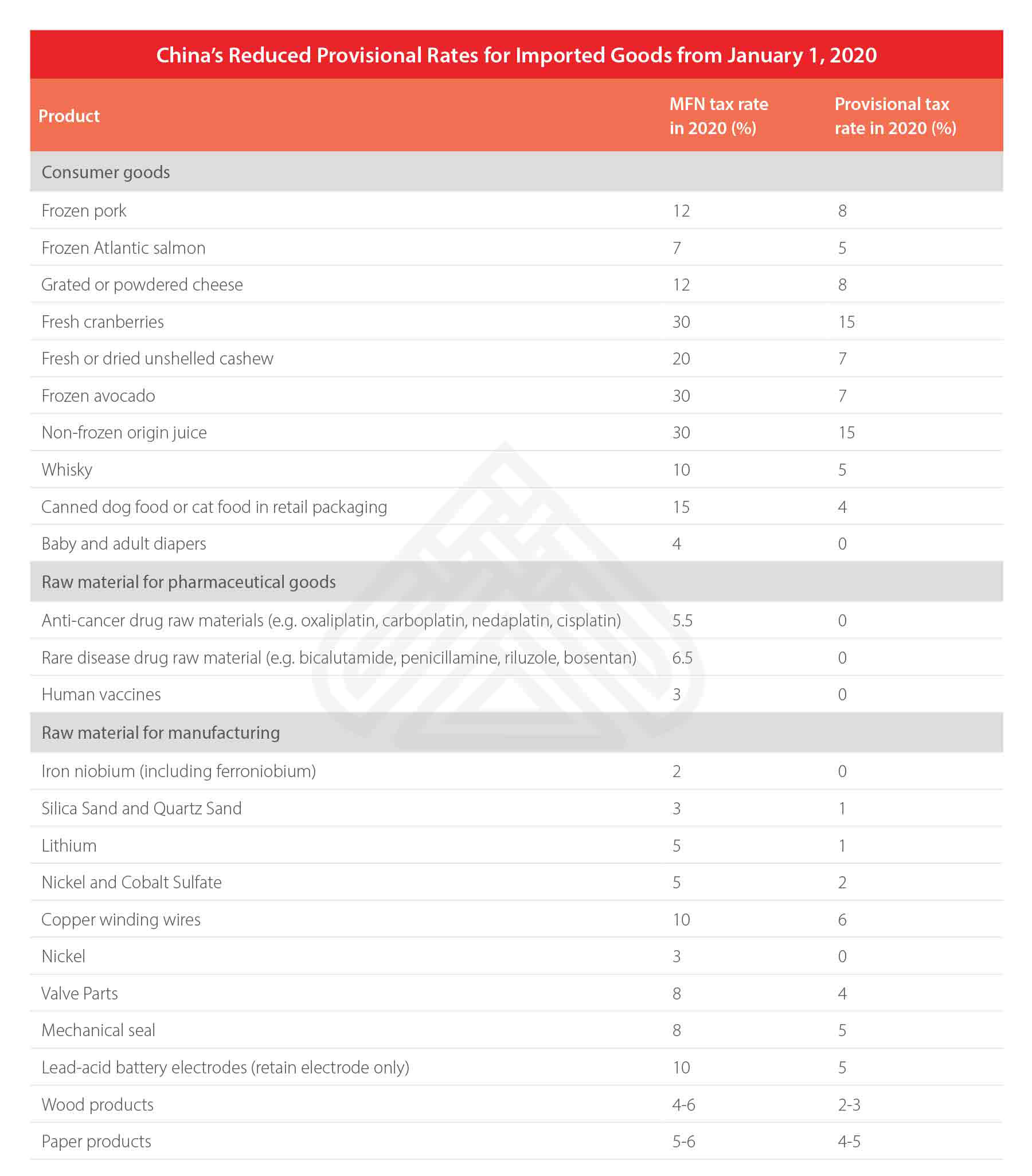

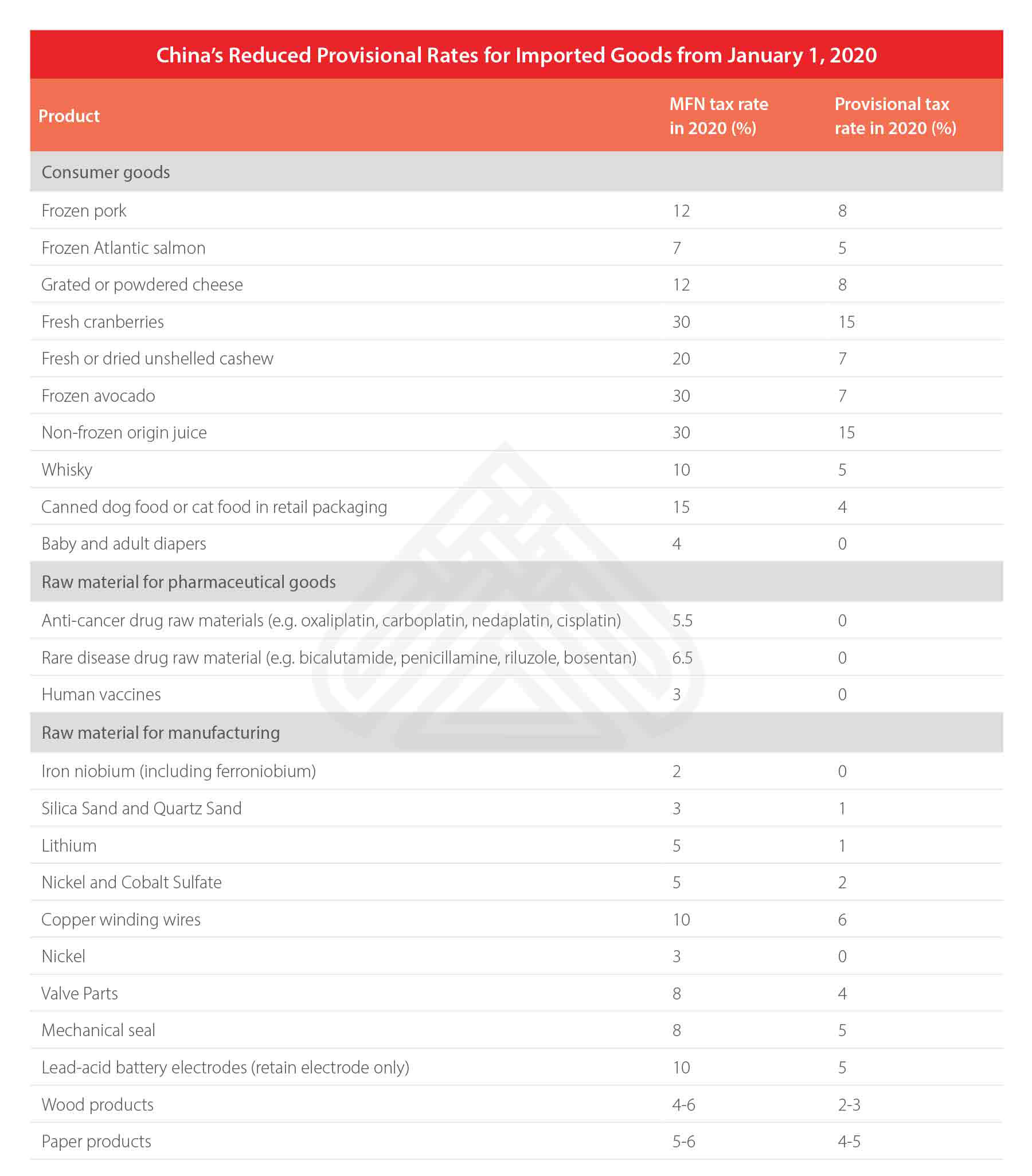

The adjusted tariffs will be lower than that of the most-favored-nation (MFN) tax rate in 2020. It will predominantly affect three categories of goods – consumer goods, raw material for pharmaceutical goods, and raw material for manufacturing of high-tech goods.

To many observers the move underlines the needs of China’s current stage of development. Strategically chosen by Beijing, the import items targeted either fill the gap in domestic production or capability as China accelerates its plans to advance its manufacturing and service industries.

Less than two weeks after China and the US reached a Phase One deal in their ongoing trade negotiations, China appears to be signaling that it is serious about diversifying its global trade relationships even as it pursues a full deal with the Trump administration.

The reduced tariffs also show China’s willingness to further open its economy in order to match the growing needs of businesses affected by the trade war. This year, China enacted similar tariff cuts covering 706 products; this newly proposed list will include 153 more products than the previous year.

The latest circular indicates that further tariff reductions will be made in accordance with China’s free trade agreements with New Zealand, Peru, Costa Rica, Switzerland, Iceland, Singapore, Australia, South Korea, Georgia, Chile, and Pakistan as well as the Asia-Pacific Trade Agreement.

However, the tariff quota management system for commodities, such as wheat, fertilizer, corn sugar, and wool will remain the same.

Seven provisional tax rates that currently apply to information technology products will also be removed from July 1, 2020. China will further lower its most-favored-nation import tariffs on 176 IT products from July 1, 2020.

What items will be affected by the adjusted import tariffs?

The lowered tariffs are intended to stimulate import potential in key areas where China faces a “relative domestic shortage”, or where there is a “high demand for foreign specialty goods “ as stated in the announcement made by the Finance Ministry.

For example, the list reduces the import tariffs on frozen pork from 12 percent to eight percent to boost domestic supply and stabilize pork prices. China is currently grappling a crisis in its domestic pork supply due to the outbreak of African swine fever since August 2018 causing a surge in pork imports. Between January to November this year, China’s pork imports amounted to 1.73 million tons, up 58 percent from the previous year.

China Briefing

China Briefing

Industry news

Industry news

Case

Case